ONE OF MY liberal friends told me a few years back that he doesn't mind filing his yearly tax returns and doesn't resent paying his taxes. In fact, he said, he doesn't make any heroic efforts to look for credits and deductions that might reduce his tax bill. "I'm with Oliver Wendell Holmes," he said. "Taxes are what we pay for civilized society."

Personally, I resent the hell out of paying taxes, and so would Oliver Wendell Holmes if he were living today. When he penned those words in 1904, the typical household wasn't spending more to pay its taxes than to pay for food, clothing, housing, and medical care combined. The federal tax code hadn't metastasized to seven million words. There was no income tax or payroll tax.

And society, in Justice Holmes's day, was still somewhat civilized.

I'm with a different jurist. Judge Learned Hand, who sat for decades on the US Court of Appeals for the Second Circuit and was widely considered the finest judge in America, wrote in 1934:

"Anyone may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose the pattern which will best pay the Treasury. There is not a patriotic duty to increase one's taxes."

Exactly. Patriots don't pay their taxes cheerfully, they pay them grudgingly. Even under the best of circumstances, good Americans ought to bridle at Washington's taxes — just as their forefathers bridled at Britain's sugar tax and stamp tax. Resistance to taxes is a hallmark of our national character. And as Charles Adams shows in a vigorous new book, Those Dirty Rotten Taxes, it has repeatedly flared into open revolt.

American tax rebellion didn't end with King George. Long after the Revolution was over, unconscionable taxes and overbearing revenue agents had Americans reaching for their guns. When Congress adopted an excise tax on whiskey during the Washington administration, farmers in western Pennsylvania exploded. Money on the frontier was scarce, and grain was often distilled into liquor and used as currency. "The 25 percent excise in hard cash was outrageous," Adams writes. "For these farmers, it was a tax on money and trade. By 1794, the entire region was in open revolt."

Calling themselves "Whiskey Boys" and taking an oath of resistance, the tax rebels set out to defeat the hated excise. Federal tax collectors were tarred and feathered. Farmers traitorous enough to pay without protest found their stills shot full of holes. In Pittsburgh, a skirmish broke out when a tax official summoned soldiers for protection. Three Whiskey Boys were killed, four soldiers were wounded, and the building housing the excise man was torched.

In August, the US Army swung into action, with a uniformed President Washington riding in command. Farmers were rounded up and sent to Philadelphia for trial. Two were sentenced to death. (In the end, a presidential pardon saved them.)

Time and again Americans have revolted against unjust tax laws; time and again the government has gone to brutal extremes to beat them down. The Internal Revenue Service may not have the power to sentence a tax protester to death, but it does have the power to make her life a costly and frightening hell; to destroy her business without any finding of guilt; to seize her papers, money, and assets; and to ruin her credit beyond repair. Last year's hearings before the Senate Finance Committee exposed case upon case of IRS viciousness and incompetence. And for every witness who testified, there are 500 more, each with a harrowing tale to tell.

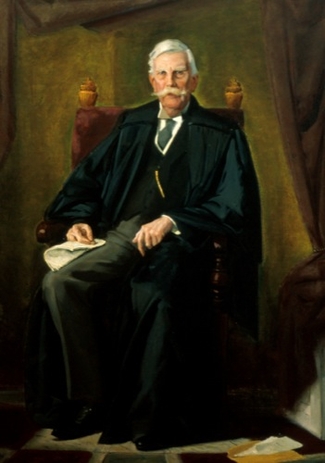

When Justice Oliver Wendell Holmes Jr. said that "taxes are the price we pay for civilized society," the federal tax code hadn't grown to millions of words and Americans paid no tax on their incomes. |

No wonder patriotic Americans resent paying taxes and despise the agency that collects them. The federal revenue machinery violates every principle of honesty, privacy, and civil liberty that democratic government depends on. You are assigned a "Tax Identification Number" at birth, and no matter where you go or what you do, the IRS finds out about it. Get a job, sell a house, earn a paycheck, take out a loan, make a deposit, start a business, write a check, receive an inheritance, buy some stock, have a baby — everything in your life is reported to the IRS.

"The IRS has agents in every US embassy to see that the US tax law is enforced," notes Adams. "No other government has revenue agents as permanent embassy attaches." Big Brother is always watching.

Will Rogers joshed that the income tax had made liars out of more Americans than golf. But it's no joke. Oppressive tax systems, high rates, and malicious revenue departments drive normal citizens into rebellion. Americans today don't tar and feather IRS agents, but they rebel all the same. They go to great lengths to shelter income. They don't report earnings. They claim crazy deductions. Anything they can do to foil the tax man, they do.

I don't know about my friend, but 80 percent of the public, according to a recent poll, thinks the IRS has too much power. Seventy-five percent believe the IRS treats taxpayers as guilty until proven innocent. Asked about allegations of unethical IRS behavior, 70 percent of respondents said such incidents occur fairly regularly; fewer than one in five believed they were isolated anomalies.

Our tax code has grown too dangerous for a free nation to tolerate, and the revenue thugs who enforce it menace our liberties. Your ancestors raised up arms to save themselves from the tax collectors. The least you can do is raise your voice.

(Jeff Jacoby is a columnist for The Boston Globe).

-- ## --

Follow Jeff Jacoby on Twitter.

Discuss his columns on Facebook.

Want to read more? Sign up for "Arguable," Jeff Jacoby's free weekly email newsletter