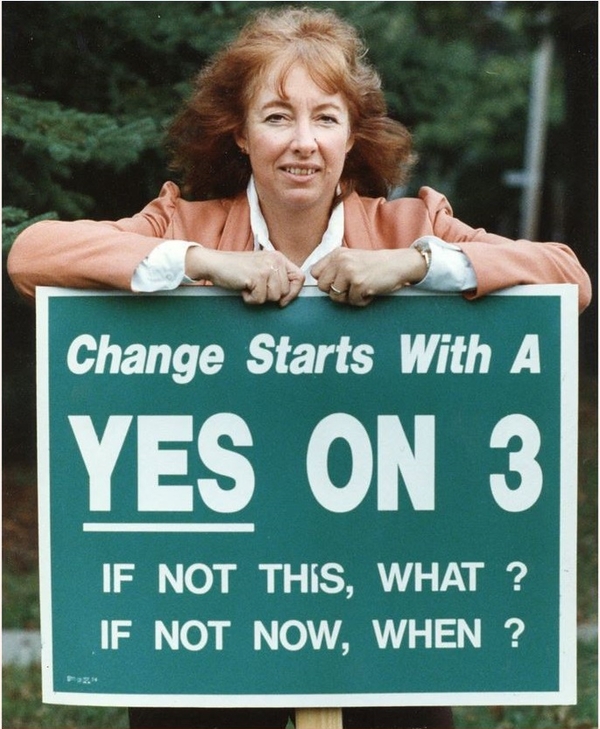

Barbara Anderson, the longtime executive director of Citizens for Limited Taxation, outside of her home in Marblehead, Mass., in 1990. |

Lower the flag to half-staff. Don a black armband. Citizens for Limited Taxation — one of the most admirable grass-roots organizations ever created in Massachusetts and the most influential ally the commonwealth's taxpayers ever had — has passed away peacefully at 48.

In a final e-mailed update to supporters and friends on Nov. 11, CLT's executive director Chip Ford reviewed the results of the election, analyzed developments on Beacon Hill, and expressed gratitude to the small band of donors who kept CLT alive for so many years. He noted with pride that CLT had saved Massachusetts taxpayers "tens of billions of their dollars" and was "leaving them in a far better place than had CLT never existed."

The most recent evidence of CLT's beneficent legacy is — literally — in the mail. Even as the organization turns out its lights for the last time, checks are being mailed this month to every single Bay State taxpayer under the terms of a 1986 law limiting state tax revenue from growing faster than the wages and salaries of Massachusetts residents. It was CLT that drafted that law and got it on the ballot in the teeth of opposition from Beacon Hill. Because CLT refused to stand down then, $3 billion is on its way back to taxpayers now.

I first heard of Citizens for Limited Taxation in 1980. I was a newcomer to the state and CLT was the moving force behind an earlier ballot initiative: Proposition 2½. In those days, residents of "Taxachusetts" staggered under one of the highest tax burdens in the nation. But they could get no relief from Beacon Hill, which was a wholly owned subsidiary of the Democratic Party and the public-employee unions.

That didn't deter CLT, a small but committed band of activists led by an intrepid free spirit named Barbara Anderson. (Ford became Anderson's codirector in 1996). In the face of wall-to-wall hostility from the state's political class, CLT urged voters to approve Proposition 2½, which was designed to cut property and auto excise taxes, and establish an income-tax deduction for renters.

Opponents warned that if Proposition 2½ passed, the results would be catastrophic. Buildings would burn to the ground for lack of firefighters, sick people would die for lack of hospitals, and children would wallow in ignorance for lack of schools. The Massachusetts League of Cities and Towns prophesied that a yes vote "would effectively wipe out government." The Boston Globe urged its readers to vote no, condemning Proposition 2½ for its "meat-ax approach" and scorning its supporters as "fanatical."

The voters trusted CLT. Proposition 2½ became law. Far from unleashing a cataclysm, the law became — as the Globe would eventually acknowledge — "the most powerful engine of change in recent Massachusetts political history" and the foremost factor in "the state's amazing turnaround."

CLT first came into existence in 1974. It was launched to fight a proposal to replace the state's flat-rate income tax with graduated tax brackets, a proposal it defeated in the 1976 election. In 1994, when a grad-tax proposal was again on the ballot, CLT again beat it back.

With hard work, fierce integrity, and good humor, CLT fought for the best interests of Massachusetts taxpayers. |

Again and again, CLT saddled up to fight for tax relief. A long crusade to roll back the income tax rate in Massachusetts to 5 percent finally prevailed in 2000. CLT repeatedly had to head off attempts by legislators to eviscerate Proposition 2½ and always found itself ridiculously outmatched, above all when it came to staff and money. At its peak, it had only four paid staffers — and they were paid a pittance. Before she retired as executive director, Anderson was getting just $10 an hour. For CLT's devoted activists, it was never about their money. It was always about the people's money. In the Commonwealth's storied history, perhaps no one since Samuel Adams has done more for the sake of Massachusetts taxpayers.

Over time, Massachusetts taxpayers came to take CLT for granted. They got used to property taxes that could no longer shoot upward, to auto excise fees that were modest, and to an income tax lower than that in many other states. Having achieved most of what it set out to accomplish, CLT saw its thousands of supporters dwindle to just a few dozen. Its funding, always modest, trickled to a halt. Anderson died of cancer in 2016; Ford, now 73, is retiring.

For nearly half a century, Citizens for Limited Taxation fought the good fight with hard work, fierce integrity, and good humor, leaving Massachusetts better than it found it. If you live in this state, CLT deserves your thanks.

(Jeff Jacoby is a columnist for The Boston Globe).

-- ## --

Follow Jeff Jacoby on Twitter.

Discuss his columns on Facebook.

Want to read more? Sign up for "Arguable," his free weekly email newsletter.